While I was working, the long commute on the Metropolitan Line to the City of London gave me ample opportunity to read the Financial Times, and prepare myself for the working day. From time to time I would read something with which I disagreed, and felt the need to challenge, or on which I was tempted to add an extra comment. Towards the end of my career I frequently indulged that whim, sending an email to the editor in the quieter moments at work. Initially I restricted my observations to business matters, but emboldened by seeing my name in print, I started to write on any matter which took my fancy.

The majority of my letters made it into print: ten were published out of perhaps fifteen between 2010 and 2015. This might be because they were well-written, relevant, incisive and witty. Or maybe the FT was just a sucker for free content.

When I announced my retirement, one client was kind enough to say he looked forward to reading more of my letters in the future, considering I would have more time on my hands. I’m sorry to have disappointed you, Richard, but now that my morning routine no longer included an hour on the Met Line, and I no longer needed psyching up for business, I had less interest in reading the paper. So my impulse to write wasn’t triggered: and my retirement as a Man of Letters was confirmed when I lost the ability to mooch off my daughter’s FT subscription, and declined to stump up the hefty sum myself.

Here, in no particular order, except for a strict chronological one, are the letters I wrote which the Financial Times has published, with their publication date. The letters are mine – the headings are the FT’s.

***************

(7 June 2010)

Buffett is too generous – Moody’s should have got it right

Sir, Warren Buffett is being very generous to say that Moody’s “made a mistake that virtually everybody in the country made” (“Buffett defends rating agencies”, June 3). Indeed, but they are supposed to be experts. If we get no warning of an earthquake, seismologists must expect the blame. Similarly, if rating agencies cannot assess credit with reasonable accuracy, we are bound to ask what they are there for.

Former managing director Eric Kolchinsky’s admission that “bankers knew we could not walk away from a deal” is staggering. How could an agency put itself in that position? It is difficult to avoid the conclusion that the fees they received for rating structured products were barely disguised bribes at best not to look too closely, at worst to actively mislead investors. Arguably the agencies’ management are as culpable as the chief executives of institutions requiring bail-out, whom Mr Buffett believes “should go away broke”.

But institutional investors should not escape their share of the blame. Those who decided to outsource investment decisions to these agencies using ratings rigidly to set their allocations are now seeing the consequences of abdicating their responsibilities.

The argument that the structured products were too complex to analyse without outside help should not get a hearing – institutions that invested in products they didn’t themselves understand got what they deserved.

***************

(13 September 2010)

The novel argument of distortion

Sir, I was interested to read James Mackintosh’s view (The Short View, September 8) that “the absence of buyers has distorted prices” of Greek government bonds. It is easy to see how this would contribute to a downward price movement, when accompanied by the presence of sellers.

But what makes this a distortion? Does he mean a lack of buyers cannot legitimately influence bond or share prices? This would make a novel argument for a chief executive defending his company’s poor share price performance.

***************

(5 December 2011)

False CDS hopes over experience

Sir, Lex is surely right to brand the “voluntary” Greek debt writedown an “inefficient outcome” (“Sovereign CDS market”, November 29). It seems very generous of governments to go to such lengths to protect the writers of credit default swaps. It is easy to see why issuance has grown so fast, if the writers so rarely have to pay up.

When CDS were quite new, I remember asking a market practitioner why if a credit was so poor that no one would bid for the bonds – anyone would be prepared to offer insurance against default.

Here is the answer: it seems that CDS don’t work. Governments again feel obliged to pick up the pieces from flawed financial products: in this case either toxic to the institutions writing them, or useless to the owners. The bonuses paid to the creators and sellers of the product have, of course, long passed out of reach.

Meanwhile, investors still willing to buy CDS are surely putting hope over experience.

***************

(3 April 2012)

Roy of the Rovers drew blank looks

Sir, I enjoyed Michael Skapinker’s piece “Penny has yet to drop for English speakers” (March 29). It reminded me of an occasion during the 1978 World Cup, when Tunisia had scored a famous win against Mexico. Bobby Charlton was given the job of interviewing one of the victorious Tunisian players. I won’t forget the baffled look on the Tunisian’s face when Bobby suggested that this was real “Roy of the Rovers” stuff.

***************

(7 October 2013)

Divided under a common language

Sir, With reference to Michael Skapinker’s article “Mystery of acquiring another language” (September 12), here is an exchange I overheard between two men in the start zone at the Berlin Marathon last month.

Number One stands close to the map of the start area, obstructing the view of Number Two, who manhandles him away.

Number One (protesting): “Hey! Tell me, but don’t touch me, OK?”

Number Two: “Shut up!”

Number One: “Did you say shut up?”

Number Two: “If you don’t like shut up, how about f*ck off?”

One of these might have been Spanish, the other might have been Turkish. I must say I took a quiet pride in English being chosen as the lingua franca for this exchange.

***************

(2 June 2014)

Charming staff are hardly robbers

Sir, Peter Stephens thinks he is being robbed in being charged £30 for the secure transfer of a sum large enough to buy a house in London (Letters, May 30).

Does he think this would be better avoided by permitting the transfer of sums like half a million pounds direct from his online account, or by the “charming staff” at HSBC, Hanover Square, working without pay? The first seems risky, the second unfair.

***************

(23 July 2014)

If it doesn’t work, why are tobacco companies against plain packaging?

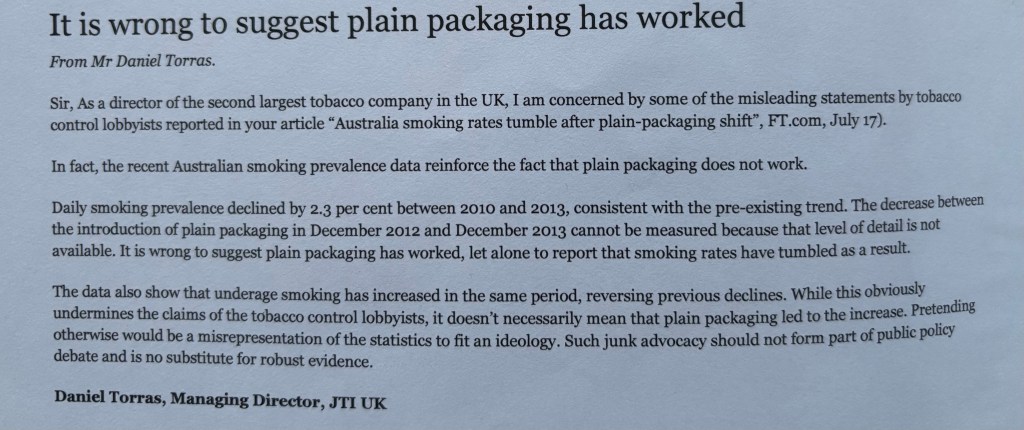

Sir, It was interesting to see the attempt by Daniel Torras (July 22) to take the moral high ground on the use of statistics in the tobacco plain packaging debate. But if participants in the tobacco industry regard it as a “fact” that plain packaging does not work, why do they continue to lobby furiously against it?

***************

(15 March 2015)

Down went Dagon

Sir, I would certainly not take issue with David Beffert’s comment (Letters, March 11) that the question of how to prevent the destruction of important archaeological sites is a pressing one. But readers might be surprised at how recently Christian worship has celebrated iconoclasm:

Down went Dagon, smashed in pieces when the ark of God came in.

So shall God destroy those idols that defile our hearts within.

Come, Lord, and destroy them.

I recall this was among the most lustily sung of the choruses at Rickmansworth Crusaders bible group in the 1970s.

***************

(1 July 2015)

Politicians would scream for successes like Sutch’s

Sir, Malcolm Levitt (Letters, June 25) correctly observes that the late Screaming Lord Sutch’s policies failed to get him elected. However, it is worth noting that the policies he espoused in his political career included (among more colourful ideas) the abolition of dog licences, the pedestrianisation of Carnaby Street, reduction of the voting age from 21 to 18, all-day pub opening, the legalisation of pop music commercial radio and the introduction of pet passports.

I suggest that few (ostensibly more successful) politicians can match his record of getting their policies enacted.

***************

(20 December 2015)

Dynamism of English is something to celebrate

Sir, Ian McMaster makes a good point (Letters, December 16) in saying that we get used to nouns which have turned into verbs. Should we really say “call using the telephone” rather than “phone”? Or that “rain is falling”, instead of “it’s raining”?

Surely the flexibility and dynamism of the English language is something to celebrate: just because a usage wasn’t standard when we learnt English at school doesn’t mean it can’t now be acceptable.

Lucy Kellaway’s intellect and wit would be better directed at genuine cases of BS (of which, as she has noted, there is never a shortage) rather than in the service of a reflex reaction against neologisms and, er, “verbing”.

Leave a comment